RECENT ARTICLES

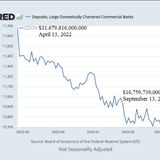

The Perfect Storm Hits Big Banks: Tumbling Deposits, Rising Unrealized Losses, and Higher-for-Longer Interest Rates

On March 30, 2022, two highly troubling events occurred: (1) Fed data showed that unrealized losses on available-for-sale securities at the 25 largest U.S. banks were approaching the levels they had reached during the financial crisis in 2008; and (2) the Fed simply stopped reporting unrealized gains and losses on these banks’ securities. As the chart above indicates, the Fed had reported this data series from October 2, 1996 to March 30, 2022 – and then, poof, it was gone and could no longer be graphed weekly at FRED, the St. Louis Fed’s Economic Data website. (See chart above from FRED.)...…On March 30, 2022, two highly troubling events occurred: (1) Fed data showed that unrealized losses on available-for-sale securities at the 25 largest U.S. banks were approaching the levels they had reached during the financial crisis in 2008; and (2) the Fed simply stopped reporting unrealized gains and losses on these banks’ securities. As the chart above indicates, the Fed had reported this data series from October 2, 1996 to March 30, 2022 – and then, poof, it was gone and could no longer be graphed weekly at FRED, the St. Louis Fed’s Economic Data website. (See chart above from FRED.)...WW…

JPMorgan’s Settlements Reach $365 Million Over Civil Claims It Banked Jeffrey Epstein’s Sex Trafficking of Minors; Criminal Charges Could Lie Ahead

JPMorgan Chase would like the public to believe that it’s going to walk away from the sleaziest financial crime of the century just $365 million poorer in the process. That’s just not going to happen. Yesterday, the bank settled for $75 million the Jeffrey Epstein related claims brought by the Attorney General of the U.S. Virgin Islands, after settling class action claims brought by Epstein’s victims for $290 million in June. (The June settlement was so questionable that we initiated an inquiry into the presiding Judge, Jed Rakoff, who called it a “really fine settlement.”) Both lawsuits...…JPMorgan Chase would like the public to believe that it’s going to walk away from the sleaziest financial crime of the century just $365 million poorer in the process. That’s just not going to happen. Yesterday, the bank settled for $75 million the Jeffrey Epstein related claims brought by the Attorney General of the U.S. Virgin Islands, after settling class action claims brought by Epstein’s victims for $290 million in June. (The June settlement was so questionable that we initiated an inquiry into the presiding Judge, Jed Rakoff, who called it a “really fine settlement.”) Both lawsuits...WW…

The Fed’s Chair and Vice Chair Got Rich at Carlyle Group, a Private Equity Fund With a String of Bankruptcies and Job Losses

Art by Nick RoneyPrivate equity funds have been variously called “merchants of debt,” “vultures,” or “corporate raiders.” What a private equity fund typically does is to buy up companies by piling debt on the balance sheet, selling off valuable assets like real estate, extracting giant dividends for the private equity partners to the detriment of workers and customers, and then, frequently, letting the company collapse into bankruptcy while laying off thousands of workers or liquidating the whole company.It should give pause to every American that the two top men at the Federal Reserve who...…Art by Nick RoneyPrivate equity funds have been variously called “merchants of debt,” “vultures,” or “corporate raiders.” What a private equity fund typically does is to buy up companies by piling debt on the balance sheet, selling off valuable assets like real estate, extracting giant dividends for the private equity partners to the detriment of workers and customers, and then, frequently, letting the company collapse into bankruptcy while laying off thousands of workers or liquidating the whole company.It should give pause to every American that the two top men at the Federal Reserve who...WW…

This Chart Shows How the Fed Manipulated Junk Bonds to Help the Dow

Thus far, the highly controversial corporate bond buying programs that the Federal Reserve first announced on March 23 have yet to spend a dime according to a spokesperson for the New York Fed, the regional Fed bank that is overseeing almost all of Wall Street’s emergency bailout programs today as well as during the financial crash of 2007 to 2010.But as the above chart indicates, just a promise from the Fed to spend billions removing toxic waste from Wall Street’s mega banks is enough to put a bid back in the junk bond market.Here’s the skinny on how the Fed propped up both the Dow and the...…Thus far, the highly controversial corporate bond buying programs that the Federal Reserve first announced on March 23 have yet to spend a dime according to a spokesperson for the New York Fed, the regional Fed bank that is overseeing almost all of Wall Street’s emergency bailout programs today as well as during the financial crash of 2007 to 2010.But as the above chart indicates, just a promise from the Fed to spend billions removing toxic waste from Wall Street’s mega banks is enough to put a bid back in the junk bond market.Here’s the skinny on how the Fed propped up both the Dow and the...WW…

Congress Sets Up Taxpayers to Eat $454 Billion of Wall Street’s Losses, Where is the Outrage?

Photograph by Nathaniel St. ClairBeginning on March 24 of this year, Larry Kudlow, the White House Economic Advisor, began to roll out the most deviously designed bailout of Wall Street in the history of America. After the Federal Reserve’s secret $29 trillion bailout of Wall Street from 2007 to 2010, and the exposure of that by a government audit and in 2011, Kudlow was going to have to come up with a brilliant strategy to sell another multi-trillion-dollar Wall Street bailout to the American people.The scheme was brilliant (in an evil genius sort of way) and audacious in employing an...…Photograph by Nathaniel St. ClairBeginning on March 24 of this year, Larry Kudlow, the White House Economic Advisor, began to roll out the most deviously designed bailout of Wall Street in the history of America. After the Federal Reserve’s secret $29 trillion bailout of Wall Street from 2007 to 2010, and the exposure of that by a government audit and in 2011, Kudlow was going to have to come up with a brilliant strategy to sell another multi-trillion-dollar Wall Street bailout to the American people.The scheme was brilliant (in an evil genius sort of way) and audacious in employing an...WW…

Catch and Kill: The Protection Racket Used by Trump, Weinstein, Epstein and Wall Street

By Pam Martens and Russ Martens: July 22, 2020 ~U.S. Attorney General, Eric Holder, Announcing the $7 Billion Settlement With Citigroup on July 14, 2014When it comes to the crime families of New York, they literally do catch and kill people who can’t be trusted to keep the secrets of their criminal operations. When it comes to the superrich in New York, they’re more inclined to “catch and kill” the story, rather than the accuser. (Jeffrey Epstein’s untimely death last year may be an exception.)On October 11, 2017, Jim Rutenberg, writing for the New York Times about the aiders and abettors...…By Pam Martens and Russ Martens: July 22, 2020 ~U.S. Attorney General, Eric Holder, Announcing the $7 Billion Settlement With Citigroup on July 14, 2014When it comes to the crime families of New York, they literally do catch and kill people who can’t be trusted to keep the secrets of their criminal operations. When it comes to the superrich in New York, they’re more inclined to “catch and kill” the story, rather than the accuser. (Jeffrey Epstein’s untimely death last year may be an exception.)On October 11, 2017, Jim Rutenberg, writing for the New York Times about the aiders and abettors...WW…

Dodd-Frank Is 10 Years Old Today and the Fed Is Back to Bailing Out Wall Street

By Pam Martens and Russ Martens: July 21, 2020 ~President Obama Signs the Dodd-Frank Wall Street Reform and Consumer Protection Act, July 21, 2010Today marks the 10th Anniversary of the enactment of the Dodd-Frank Wall Street Reform and Consumer Protection Act, named after its two sponsors, former Senator Christopher Dodd (D-CT) and former Congressman Barney Frank (D-MA). The massive piece of legislation was signed into law on July 21, 2010 by President Barack Obama at a time when Democrats controlled both houses of Congress – meaning there was no excuse not to put tough Wall Street reform...…By Pam Martens and Russ Martens: July 21, 2020 ~President Obama Signs the Dodd-Frank Wall Street Reform and Consumer Protection Act, July 21, 2010Today marks the 10th Anniversary of the enactment of the Dodd-Frank Wall Street Reform and Consumer Protection Act, named after its two sponsors, former Senator Christopher Dodd (D-CT) and former Congressman Barney Frank (D-MA). The massive piece of legislation was signed into law on July 21, 2010 by President Barack Obama at a time when Democrats controlled both houses of Congress – meaning there was no excuse not to put tough Wall Street reform...WW…

U.S. Attorney Geoffrey Berman’s Ouster: The Untold Story

By Pam Martens and Russ Martens: June 23, 2020 ~A Stake in the Park Lane Hotel in Manhattan Was Purchased With Money Looted from 1MDB According to the U.S. Justice Department (Photo Source: DOJ)There’s something unsettling about the top law enforcement officer in the United States telling a brazen lie to the American people late on a Friday night when most folks have called it quits for the week on the news. Shortly after 9 p.m. last Friday evening, the U.S. Attorney General, William Barr, indicating that the top federal prosecutor for the Southern District of New York, Geoffrey Berman, was...…By Pam Martens and Russ Martens: June 23, 2020 ~A Stake in the Park Lane Hotel in Manhattan Was Purchased With Money Looted from 1MDB According to the U.S. Justice Department (Photo Source: DOJ)There’s something unsettling about the top law enforcement officer in the United States telling a brazen lie to the American people late on a Friday night when most folks have called it quits for the week on the news. Shortly after 9 p.m. last Friday evening, the U.S. Attorney General, William Barr, indicating that the top federal prosecutor for the Southern District of New York, Geoffrey Berman, was...WW…

- Total 8 items

- 1