RECENT ARTICLES

Report: SoftBank is taking control of WeWork at an ~$8B valuation

WeWork, once valued at $47 billion, will be worth as little as $7.5 billion on paper as SoftBank takes control of the struggling co-working business, CNBC .SoftBank, a long-time WeWork investor, plans to invest between $4 billion and $5 billion in exchange for new and existing shares, according to CNBC. The deal, expected to be announced as soon as tomorrow, represents a lifeline for WeWork, which is said to be mere weeks from running out of cash and has been as it attempts to lessen its cash burn.WeWork declined to comment.To be clear, it is reportedly the Vision Fund’s parent company,...…WeWork, once valued at $47 billion, will be worth as little as $7.5 billion on paper as SoftBank takes control of the struggling co-working business, CNBC .SoftBank, a long-time WeWork investor, plans to invest between $4 billion and $5 billion in exchange for new and existing shares, according to CNBC. The deal, expected to be announced as soon as tomorrow, represents a lifeline for WeWork, which is said to be mere weeks from running out of cash and has been as it attempts to lessen its cash burn.WeWork declined to comment.To be clear, it is reportedly the Vision Fund’s parent company,...WW…

If Sam Altman Returns to OpenAI, Board Will Go

OpenAI’s ousted CEO Sam Altman was discussing a return to the startup he co-founded Saturday, after a flood of employee support and as major investors pressured the board to reverse the decision. His return would invite a new bout of upheaval: the members of the board would have to be replaced, according to a person familiar with the discussions. Alternatively, Altman would continue with plans to launch a new venture. Saturday evening, dozens of people, including OpenAI employees, were leaving Altman’s $27 million mansion in the tony Russian Hill neighborhood of San Francisco, after...…OpenAI’s ousted CEO Sam Altman was discussing a return to the startup he co-founded Saturday, after a flood of employee support and as major investors pressured the board to reverse the decision. His return would invite a new bout of upheaval: the members of the board would have to be replaced, according to a person familiar with the discussions. Alternatively, Altman would continue with plans to launch a new venture. Saturday evening, dozens of people, including OpenAI employees, were leaving Altman’s $27 million mansion in the tony Russian Hill neighborhood of San Francisco, after...WW…

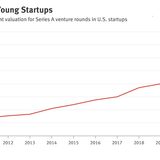

‘Can’t Get More Crazy’: Series A Valuations Extend Record Rise

Financial software developer Orum, which disclosed a seed round over the summer, wasn’t seeking more capital when Bain Capital Ventures offered to lead its Series A investment last year. But the one-year-old startup took the money anyway and got a post-investment valuation of $100 million, according to a person with direct knowledge of the deal. Such unsolicited deals, carrying price tags once equated with more mature companies, have been driving early-stage valuations to record highs.The median pre-investment valuation for a Series A round of funding has increased sixfold to $37 million...…Financial software developer Orum, which disclosed a seed round over the summer, wasn’t seeking more capital when Bain Capital Ventures offered to lead its Series A investment last year. But the one-year-old startup took the money anyway and got a post-investment valuation of $100 million, according to a person with direct knowledge of the deal. Such unsolicited deals, carrying price tags once equated with more mature companies, have been driving early-stage valuations to record highs.The median pre-investment valuation for a Series A round of funding has increased sixfold to $37 million...WW…

Tech CEOs Are Saying Goodbye to San Francisco

Photo: Brex co-CEO Henrique Dubugras, Dropbox CEO Drew Houston and Splunk CEO Doug Merritt. Photos: BloombergSplunk, Dropbox and Brex followed similar formulas as they grew from small startups to established companies. To attract employees and customers, each set up elaborate San Francisco offices and plastered billboards for its services around the city. Dropbox three years ago leased a giant new office building on the city’s eastern edge. Fintech firm Brex even opened its own cafe in a neighborhood popular with venture capitalists.Now, all three companies embody a new trend: Their chief...…Photo: Brex co-CEO Henrique Dubugras, Dropbox CEO Drew Houston and Splunk CEO Doug Merritt. Photos: BloombergSplunk, Dropbox and Brex followed similar formulas as they grew from small startups to established companies. To attract employees and customers, each set up elaborate San Francisco offices and plastered billboards for its services around the city. Dropbox three years ago leased a giant new office building on the city’s eastern edge. Fintech firm Brex even opened its own cafe in a neighborhood popular with venture capitalists.Now, all three companies embody a new trend: Their chief...WW…

Austin Emerges as a Hot Spot for Silicon Valley Investors

Austin’s startup scene is getting a jolt of new capital, this time from a wave of investors transplanted from Silicon Valley.Since March, Sapphire Ventures, Draper Associates, 8VC and Breyer Capital have either opened an Austin office, hired a local partner or are considering an outpost there. Austin’s lack of a state income tax, plus its lower cost of living, is attracting venture capitalists and entrepreneurs, and a push toward remote work has spurred them to rethink where they live. Local venture firms are also expanding. Third Craft, a new firm backed by former Heinz CEO William...…Austin’s startup scene is getting a jolt of new capital, this time from a wave of investors transplanted from Silicon Valley.Since March, Sapphire Ventures, Draper Associates, 8VC and Breyer Capital have either opened an Austin office, hired a local partner or are considering an outpost there. Austin’s lack of a state income tax, plus its lower cost of living, is attracting venture capitalists and entrepreneurs, and a push toward remote work has spurred them to rethink where they live. Local venture firms are also expanding. Third Craft, a new firm backed by former Heinz CEO William...WW…

News discovery app SmartNews valued at $1.1B

A $28 million financing has made , an AI-powered news aggregation app, a unicorn.Japan Post Capital led the Series E round, which brings the company’s total investment to $116 million and pushes its valuation to $1.1 billion. Existing investors in SmartNews include Development Bank of Japan, SMBC Venture Capital and Japan Co-Invest LP.The company, founded in Tokyo in 2012, boasts 20 million monthly active users in the U.S. and Japan. Growing at a rate of 500% per year, its audience checks into the app for a mix of political, sports, global and entertainment news curated for each individual...…A $28 million financing has made , an AI-powered news aggregation app, a unicorn.Japan Post Capital led the Series E round, which brings the company’s total investment to $116 million and pushes its valuation to $1.1 billion. Existing investors in SmartNews include Development Bank of Japan, SMBC Venture Capital and Japan Co-Invest LP.The company, founded in Tokyo in 2012, boasts 20 million monthly active users in the U.S. and Japan. Growing at a rate of 500% per year, its audience checks into the app for a mix of political, sports, global and entertainment news curated for each individual...WW…

What Comes Next for Sam Altman’s OpenAI

Sam Altman is back as OpenAI’s CEO. Now he faces the hard part: mending the fracture that led to his ouster less than five days before—and repairing an image that had lost its shine as the corporate drama spilled into the public view. Among the most immediate challenges will be determining the role of Ilya Sutskever, the company’s visionary chief scientist, and his allies on the company’s AI safety team who initially supported Altman’s ouster. At the same time, Altman needs to act quickly to undo any damage to OpenAI’s standing with its customers and employees. OpenAI competitors such as...…Sam Altman is back as OpenAI’s CEO. Now he faces the hard part: mending the fracture that led to his ouster less than five days before—and repairing an image that had lost its shine as the corporate drama spilled into the public view. Among the most immediate challenges will be determining the role of Ilya Sutskever, the company’s visionary chief scientist, and his allies on the company’s AI safety team who initially supported Altman’s ouster. At the same time, Altman needs to act quickly to undo any damage to OpenAI’s standing with its customers and employees. OpenAI competitors such as...WW…

Village Global's accelerator introduces founders to Bill Gates, Reid Hoffman, Eric Schmidt and more

Village Global is leveraging its network of tech luminaries to support the next generation of entrepreneurs.Theearly-stage venture capital firm, which counts as limited partners (LPs) Microsoft’s Bill Gates, Facebook’s Mark Zuckerberg, Alphabet’s Eric Schmidt, Amazon’s Jeff Bezos, LinkedIn’s Reid Hoffman and many other high-profile techies, quietly announced on Friday that the accelerator it piloted earlier this year would become a permanent fixture.Called , Village provides formation-stage startups with $150,000 and three-months of programming in exchange for 7 percent equity. Its key...…Village Global is leveraging its network of tech luminaries to support the next generation of entrepreneurs.Theearly-stage venture capital firm, which counts as limited partners (LPs) Microsoft’s Bill Gates, Facebook’s Mark Zuckerberg, Alphabet’s Eric Schmidt, Amazon’s Jeff Bezos, LinkedIn’s Reid Hoffman and many other high-profile techies, quietly announced on Friday that the accelerator it piloted earlier this year would become a permanent fixture.Called , Village provides formation-stage startups with $150,000 and three-months of programming in exchange for 7 percent equity. Its key...WW…

- Total 8 items

- 1